Source: CCTV.com

02-09-2009 11:20

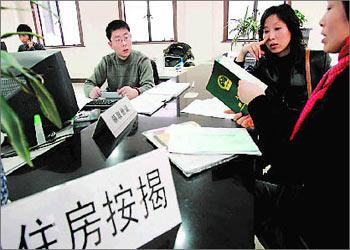

Earlier this year, many domestic banks announced a 30 percent discount on mortgage rates for existing clients. But in some cities, home buyers find it difficult to get the preferential rate.

|

| Earlier this year, many domestic banks announced a 30 percent discount on mortgage rates for existing clients. |

On January the third, major Chinese banks announced an extension of lower mortgage rates for home buyers in an effort to boost a weak property market. They are now offering mortgage rates at 70 percent of the benchmark rate to individuals who sought mortgages before October the 27th 2008. But eager customers in Chongqing found out that it's not that easy to get the preferential rate. Besides credit requirement from the central bank, these commercial banks have some additional demands.

Mr. Zeng, Chongqing resident, says, "The bank requires us to deposit 50 thousand yuan for half a year's fixed deposit. For this period of time, we cannot withdraw the money. The question is - if I really have the money, there will be no need for me to apply for the preferential mortgage rate. I will just pay the money to the bank for the mortgage."

While for this lady, there are harsher requirements. She still owes the bank a 220 thousand yuan mortgage. The bank told her, if she wants to apply for the preferential rate, her outstanding mortgage has to be above 300 thousand yuan; or she must become a senior client, which means her total assets in the bank are above half a million yuan.

Ms.Lei, Chongqing resident, says, "my response was: if I'm a senior client and have the money required, I've already paid off the mortgage."

Local people say it's a general practice that branches of these commercial banks impose additional requirements for home buyers, although their headquarters have never made such demands.

Click for more news in Biz China>>

Editor:Qin Yongjing