Source: CCTV.com

01-11-2008 08:54

The new Corporate Income Tax Law took effect this month. The new law unifies the income tax rates for domestic and foreign invested companies. That's expected to have far-reaching effects on both local and overseas enterprises.

|

| The new Corporate Income Tax Law unifies the income tax rates for domestic and foreign invested companies. |

One important revision to the law is to unify the tax rate at 25 percent for domestic and foreign-funded companies. Experts say this will put the firms on equal footing in income taxation to promote fair competition.

Zheng Yuewen, one entrepreneur said "The different tax rates have become a form of discrimination against domestic companies. It damages our competitiveness. Most Chinese enterprises are not supported and protected, but the market has opened much wider for foreign firms. We need a level playing field."

The previous tax rate for local firms was 33 percent, while the average for most foreign firms was around 15 percent.

Opened up to the world for some 30 years now, China's investment environment has dramatically improved. And that calls for a corresponding adjustment to economic policies.

Mei Xinyu, Researcher of Academy of Int'l Trade & Economic Cooperation said "The situation is totally different today. China is now a better place for foreign companies. The country needs to treat domestic and foreign companies the same. That will be vital to developing our national economy, as well as to attracting high-quality foreign investment."

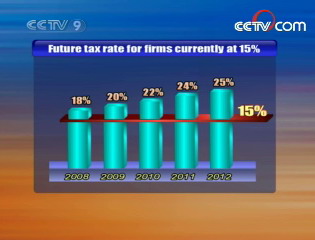

Aimed at cushioning the impact, China will phase in the new law in five years. Companies that currently face an income tax of 15 percent will see their tax rate increase to 25 percent in 5 years.

|

| The new Corporate Income Tax Law unifies the income tax rates for domestic and foreign invested companies. |

Companies that were exempt from taxes or had concessional rates will retain their preferential rates until the original expiration date.

Companies in the western part of the country will not be affected by the new law and will continue to enjoy preferential rates.

Many foreign firms have accepted the tax hike. They say that when making investment decisions, factors such as political stability, strong economic momentum and market potential are much more important than mere tax policies.

China currently attracts huge amounts of FDI every year. Experts say that unifying the tax rate is not a sign of impending policy moves directed against foreign investment. Instead, it's a big step forward in improving China's market-oriented economy.

Editor:Xiong Qu