Ben Bernanke: US continue low-interest policy

2010-01-04 18:26 BJT

The Chairman of the US Federal Reserve, Ben Bernanke, says the country should continue its low-interest policy. He added that the best way to restrain the housing bubble is strengthening supervision, and not monetary policies.

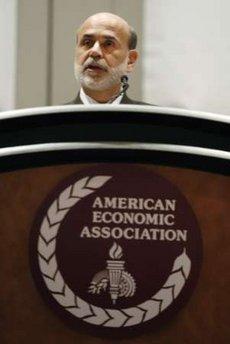

Bernanke made the remarks at an annual meeting of the American Economic Association in Atlanta. Critics have said the US central bank kept interest rates too low in the early 2000s. But Bernanke has argued that regulatory failure, not lax monetary policy, was responsible for the housing bubble and subsequent financial crisis.

Moreover, Bernanke stated that cross-country evidence shows no significant relationship between monetary policies and the pace of housing price increases.

|

| Federal Reserve Chairman Ben Bernanke speaks during a presentation at the American Economic Association Conference in Atlanta, Georgia, January 3, 2010. Bernanke on Sunday repeated his confidence that the Fed will be able to withdraw its extraordinary support for the economy when the time comes.REUTERS/Tami Chappell |

Mail

Mail Share

Share Print

Print

Video

Video

2009 China Central Television. All Rights Reserved

2009 China Central Television. All Rights Reserved