Overseas voices oppose stronger yuan

2010-03-25 11:34 BJTSpecial Report: Yuan Not to Blame for Trade Surplus |

Although the US is pushing for a stronger yuan, many international organization officials, experts and overseas media say otherwise. They hold that China has the right to decide its own exchange rate policy. They say the current basic stable yuan exchange rate is good for the steady recovery of the world economy.

|

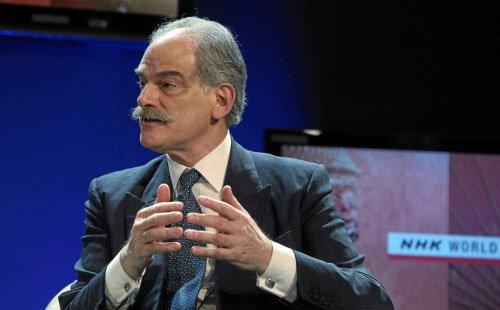

| John Lipsky is the deputy managing director of the International Monetary Fund. |

John Lipsky is the deputy managing director of the International Monetary Fund. He says it's unfortunate the issue of exchange rate policies is somewhat being taken out of context and viewed as a simple solution, or the only or key aspect, in terms of policy adjustment.

The Wall Street Journal published an article titled "Tagging the yuan as scapegoat is unfair". It says large appreciation will harm China's economic growth and will not solve the US trade deficit.

A former US Deputy Treasury Secretary, Frank Newman, has an article on the Foreign Policy website. He says calls for a stronger yuan are "based on the assumption that if the yuan is more expensive relative to the dollar, US domestic production will rise and the US trade imbalance will fall. But neither assumption is correct."

Michael Schuman is a senior correspondent of US magazine Time. He points out when the yuan was appreciating against the US dollar, from 2005 to 2008, the US trade deficit with China actually increased. He says a stronger yuan might make Chinese goods sold in the US market more expensive, and that would not be good for US consumers already burdened by debt and job instability.

An editorial in the Singapore newspaper Lianhe Zaobao warns of the danger of a trade war between China and the US. It says the world economy, which has not fully recovered from the global financial crisis, would fall back into recession.

Editor: Du Xiaodan | Source: CCTV.com

Mail

Mail Share

Share Print

Print

Video

Video

2009 China Central Television. All Rights Reserved

2009 China Central Television. All Rights Reserved